Response to TCFD Recommendations

Climate change initiatives and response to TCFD Recommendations

The Group recognizes that addressing climate change is an important management issue. In this regard, the

Group is strengthening its governance system to contribute to realization of a decarbonized society, and is

analyzing the impact of climate change on its business, capturing growth opportunities, and taking

appropriate actions to address risks.

In March 2022, the Group announced our support for the recommendations of the TCFD (Task Force on

Climate-related Financial Disclosure) established by the FSB (Financial Stability Board). Going forward, the

TCFD recommendations will be actively utilized to enhance information disclosure and promote the Group’s

climate change initiatives, as well as to promote sustainability management.

Governance

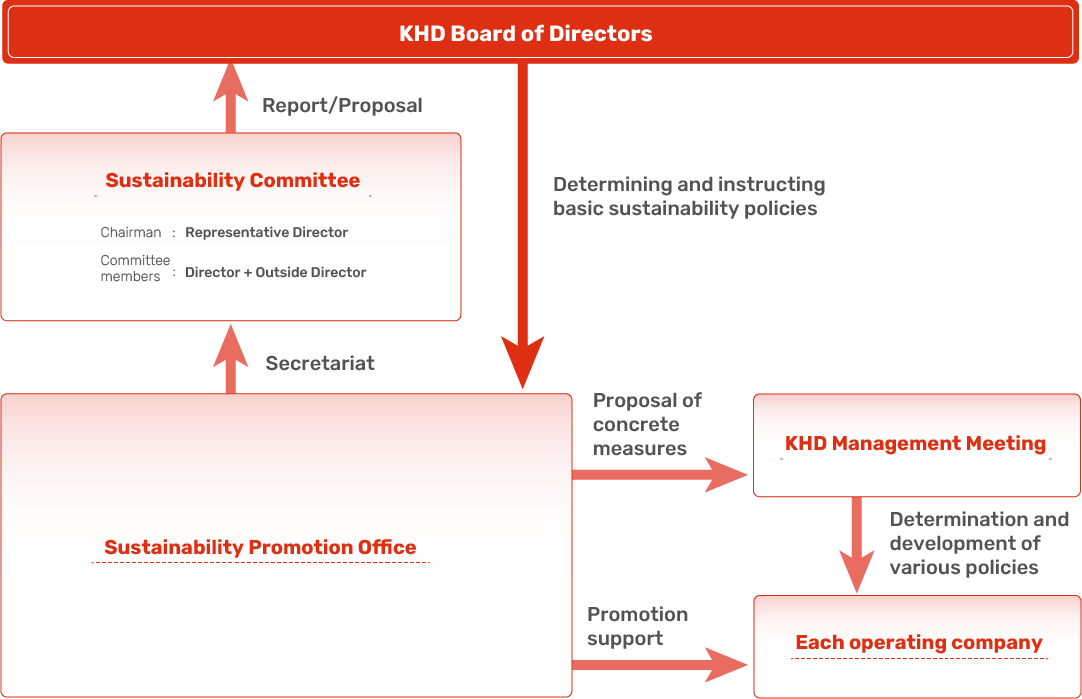

In January 2022, Kitamura Holdings (“KHD”) established a Sustainability Committee chaired by the

Representative Director to promote sustainability management across the Group. In addition, an officer in charge (CSuO) has been appointed in line with the Basic Sustainability Policy approved by the KHD Board of Directors, and the KHD President’s Office is responsible for promoting specific initiatives as a cross-Group department.

The KHD Board of Directors receives reports on the resolutions made by the Sustainability Committee, decides

on and gives instructions regarding Basic Sustainability Policy, and discusses and supervises the Group’s

policies and action plans for dealing with environmental issues.

Strategy

The Group classifies risks and opportunities related to climate change as high, medium, or low based on the financial impact, which also indicates its impact and monetary business impact. The Group categorizes risks as physical or transition risks and divides opportunities into two categories in its business strategy: the growth area of “Camera & Resale,” and the stable area of “Photo-life Services.” The Group’s responses and the associated timeframes are organized as follows to demonstrate the Group’s resilience.

| Impact on our Group | Group response | Period※ | Impact | Business impact | |||

|---|---|---|---|---|---|---|---|

| Risks | Physical risks |

Chronic risks | Reduced opportunities to go outside due to extreme heat and heat waves | Provision of online services | Long term | Low | Approx. 32 million yen (per year) |

| Acute risks | Loss of business opportunities due to store closures and supply chain disruptions caused by large-scale flooding | Strengthening of disaster BCP measures, flood risk map creation, production site decentralization | Medium term | Medium | Approx. 320 million yen (when incidents occur) |

||

| Transition risks |

Policies, laws, and regulations | Increase in operating costs as a result of introduction of carbon tax systems | Consideration of installation of solar panels in stores, plants, and offices | Long term | Medium | Approx. 180 million yen (per year) |

|

| Technology | Difficulty in procuring raw materials | Consideration of alternative raw materials (such as recycled paper), diversification of procurement sources | Medium term | Low | Approx. 22 million yen (per year) |

||

| Oppor- tunities |

Camera & Resale | Products and services | Increased demand for environmentally friendly products such as used products and services and recycled products prompted by rising environmental consciousness and lifestyle changes | Increase in the number of reused and recycled products handled, expansion of repair business | Medium term | High | Approx. 2,500 million yen (per year) |

| Photo-life Services | Products and services | Development of low-carbon and environmentally friendly products, use of recycled materials | Development and provision of low-carbon products, environmentally friendly products, and products made with recycled materials | Medium term | Medium | Approx. 500 million yen (per year) |

|

| Resource efficiency | Improvement in efficiency of production and distribution processes | Reduction of costs through efficiency improvements in manufacturing, distribution, and sales processes made possible through use of digital transformation | Medium term | Medium | Approx. 320 million yen (when incidents occur) |

||

| Energy sources | Energy production in plants and offices | Consideration of installation of solar panels in plants and offices, reduction of energy costs | Short term | Low | Approx. 30 million yen (per year) |

||

- *“Short term” refers to the period from 2025 to 2026, “medium term” to the period from 2027 to 2030, and “long term” to the period from 2031 to 2050.

The premise for these considerations is a scenario analysis of whether warming can be limited to 1.5 degrees

Celsius or will exceed 3.0 degrees Celsius in 2050.

The scenario analysis used group scenarios that combine the temperature scenarios (RCP) and socioeconomic

scenarios (SSP) of the Intergovernmental Panel on Climate Change (IPCC). Specifically, to prepare for a wide

range of future visions related to climate change, two scenarios were developed: the 1.5/2°C scenario, in

which society as a whole transitions to decarbonization and succeeds in controlling the temperature rise,

and the 3°C scenario, in which economic development takes priority and the global temperature rise and its

impacts continue to worsen.

For the 1.5/2°C scenario, the IPCC AR5 RCP2.6 and AR6 WG1 SSP1-1.9 scenarios were referenced, while for the

3°C scenario, the IPCC AR5 RCP6.0 and AR6 WG1 SSP2-4.5 scenarios were referenced.

We conduct ongoing scenario analysis on an annual basis.

Risk management

The Group regards risk management as an important initiative for improving its corporate value, and

identifies and assesses risks, prioritizes them based on their frequency of occurrence and impact,

determines countermeasures such as avoidance, mitigation, transfer, and retention, and manages progress.

These processes are regularly reported to the KHD Board of Directors by the Risk Management Group, which is

the KHD department in charge.

Furthermore, with regard to risks related to climate change, the KHD President’s Office

monitors, assesses, and identifies the key risks, which, together with other risks, are reported to the KHD

Board of Directors and reflected in the Group’s strategy.

Metrics and targets

For greenhouse gas (GHG) emissions (Scope 1 and 2), we are targeting a 60% real reduction by 2030 compared to the fiscal year that ended March 31, 2020, and net zero emissions by 2050. For Scope 3, our interim target is a 25% real reduction by 2030 compared to the fiscal year that ended March 31, 2023. We will continue to cooperate with our business partners to reduce greenhouse gas emissions from our stores, supply chain, and product offerings, promote energy conservation, and improve energy efficiency in our operations.

In addition, to promote sustainability management, the Group sets ESG KPIs for some executive officers who are responsible for business execution, which is reflected through the equivalent of 5% to 10% of their incentive compensation, depending on the level of achievement.

| Type | Measure | Asset | 2019 - 2022 | 2023 - 2030 | 2031 - 2050 |

|---|---|---|---|---|---|

| Energy conservation | LED lighting installation | Stores | |||

| LED lighting installation | Plants | ||||

| Energy efficient production equipment installation | Plants | ||||

| LED lighting installation | HQ | ||||

| Renewable energy | Switching to renewable electricity | Stores | |||

| Solar power generation installation | Plants |